Unpaid AWS invoices do not directly affect credit. However, failure to pay them can result in account suspension or termination, which may impact creditworthiness indirectly.

Non-payment can also lead to additional fees and penalties, affecting financial stability and reputation. It is crucial to promptly settle AWS invoices to avoid any negative consequences. Cloud computing has become an integral part of many businesses, with Amazon Web Services (AWS) being one of the leading providers in this field.

However, concerns may arise regarding the impact of unpaid AWS invoices on credit. In this blog post, we will address this issue and provide a clear understanding of the relationship between unpaid AWS invoices and credit. By delving into the potential consequences and highlighting the importance of timely payment, businesses can make informed decisions and mitigate any adverse effects on their financial standing. So, let’s explore the impact of unpaid AWS invoices on credit and why it is crucial to address them promptly.

Introduction To Aws And Billing

AWS (Amazon Web Services) is a leading cloud service provider offering a wide range of services to businesses and individuals. Understanding AWS billing is crucial to avoid any unexpected charges.

Aws Payment Policies

AWS follows strict payment policies to ensure a smooth billing process. It is essential to familiarize yourself with these policies to manage your expenses effectively.

Common Billing Scenarios

- Hourly Usage Charges

- Data Transfer Costs

- Storage Fees

Being aware of these common billing scenarios can help you track your expenses and optimize your AWS usage efficiently.

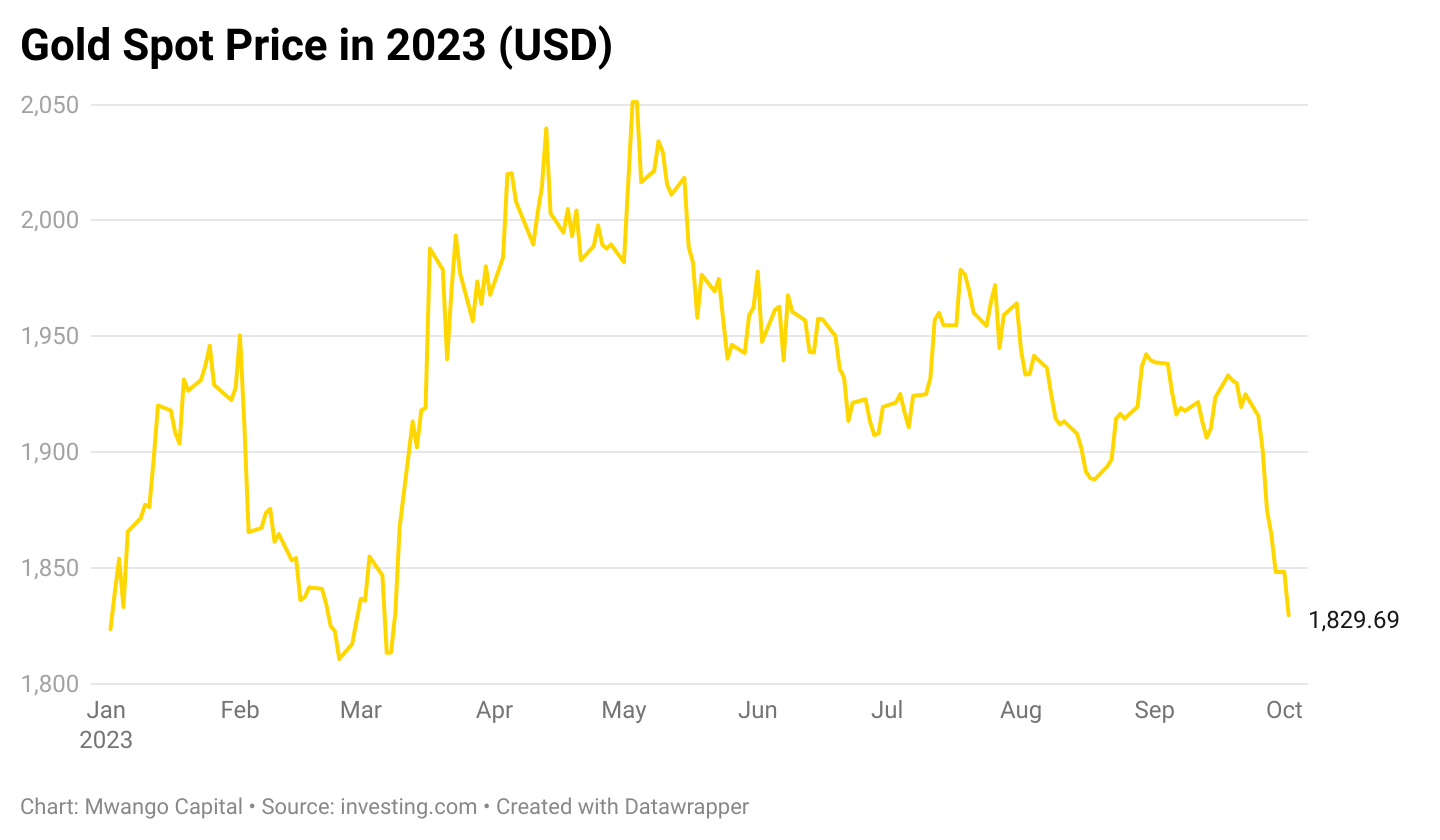

Credit: mwangocapital.substack.com

Unpaid Invoices: A Primer

Unpaid AWS invoices can negatively impact credit scores, affecting financial reputation and future borrowing opportunities. Timely payment is crucial to avoid credit implications and maintain a positive financial standing.

As a business owner, you may wonder whether an unpaid AWS invoice can affect your credit. AWS (Amazon Web Services) is a cloud-based computing platform that provides businesses with a range of IT services. However, sometimes businesses miss payment deadlines, leading to unpaid invoices. In this post, we will explore the implications of unpaid AWS invoices and the time frame for payment.What Happens When You Miss A Payment

Missing a payment deadline can have serious consequences for your business. When you miss an AWS payment, you will receive a notification that your account has been suspended. This means that your business will no longer have access to AWS services until the unpaid invoice is settled. Moreover, AWS may charge you a late payment fee, which can increase the amount you owe. If you continue to miss payments, AWS may take legal action against your business. This can have a negative impact on your credit rating and your ability to obtain credit in the future. Therefore, it is important to pay your AWS invoices on time to avoid these consequences.Time Frame For Unpaid Aws Invoices

AWS invoices are typically due within 30 days of the invoice date. If you do not pay the invoice by the due date, AWS will send you a reminder email. If you still do not pay the invoice, your account will be suspended, and AWS will continue to send you reminder emails until the invoice is paid. If you have not paid the invoice after 60 days, AWS may take legal action against your business. This can lead to a negative impact on your credit rating, making it difficult to obtain credit in the future. In conclusion, it is important to pay your AWS invoices on time to avoid suspension of services, late payment fees, and negative impacts on your credit rating. If you are having difficulty paying your invoices, it is best to contact AWS customer service to discuss payment options.Credit Scores Explained

Credit scores play a crucial role in an individual’s financial health. Understanding the components of a credit score and how late payments can affect credit is essential for maintaining a good credit standing. Let’s delve into the intricacies of credit scores and how unpaid AWS invoices can impact them.

Components Of A Credit Score

A credit score is determined by various factors, including payment history, credit utilization, length of credit history, new credit, and credit mix. Payment history carries the most weight, accounting for about 35% of the overall score. Timely payments on bills and debts demonstrate financial responsibility and positively impact the credit score. On the other hand, late payments can significantly diminish the score.

How Late Payments Can Affect Credit

Late payments, whether on credit cards, loans, or bills, can lead to a decrease in the credit score. A single late payment can cause a noticeable drop in the score, especially if the payment is more than 30 days overdue. Persistent late payments can result in further deterioration of the score, making it challenging to secure favorable terms on loans and credit cards.

Aws And Credit Reporting

Unpaid AWS invoices can impact credit scores if the account goes to collections. It’s crucial to settle any outstanding bills promptly to avoid negative effects on your credit report. Keeping track of your AWS billing and ensuring timely payments can help prevent any potential credit issues.

Aws’s Approach To Credit Reporting

AWS, like most service providers, does not report unpaid invoices to credit bureaus. This means that if you have an unpaid AWS invoice, it will not affect your credit score. However, if your account goes into collections, then that could potentially impact your credit score. AWS typically sends multiple reminders before moving an account to collections, giving you time to pay your invoice.Comparing Aws To Traditional Credit Lines

Unlike traditional credit lines, AWS does not report to credit bureaus. This means that using AWS services will not affect your credit utilization ratio or credit score. However, it’s important to note that if you fall behind on payments and your account goes into collections, that could impact your credit score. Additionally, if you have a business credit card linked to your AWS account, any missed payments on that card could also potentially impact your credit score.Summary

In summary, AWS does not report unpaid invoices to credit bureaus. However, if your account goes into collections, that could potentially impact your credit score. It’s important to stay on top of your payments and pay your invoices on time to avoid any negative impact on your credit score.Real Impact On Credit Score

Unpaid AWS invoices can have a direct impact on your credit score, potentially affecting your financial reputation. It’s essential to understand how this can happen and the indirect consequences it can have on your overall creditworthiness.

Understanding The Direct Impact

When you fail to pay your AWS invoice on time, it can result in a negative mark on your credit report. This negative mark indicates that you have not fulfilled your financial obligations, which can be viewed unfavorably by lenders and other financial institutions.

Furthermore, the longer the invoice remains unpaid, the more severe the impact on your credit score. Late payments, especially those that are significantly overdue, can lower your credit score and make it more challenging to obtain credit in the future.

Indirect Consequences Of Unpaid Invoices

In addition to the direct impact on your credit score, unpaid AWS invoices can have indirect consequences that further affect your creditworthiness. These consequences include:

- Collection Agencies: Unpaid invoices may be sent to collection agencies, which can further damage your credit score. Collection agencies are known for their aggressive tactics in pursuing payment, and their involvement can be detrimental to your financial reputation.

- Legal Action: If the unpaid invoice remains unresolved, AWS or the service provider may take legal action against you. This can result in a judgment against you, which can have severe implications for your creditworthiness.

- Difficulty Obtaining Credit: With a negative mark on your credit report and potential involvement of collection agencies or legal action, obtaining credit in the future can become challenging. Lenders may view you as a higher risk borrower, making it harder to secure loans, credit cards, or other financial products.

- Higher Interest Rates: Even if you are able to obtain credit with a lower credit score, the interest rates offered to you may be significantly higher. This means you could end up paying more in interest over the life of the loan or credit card.

It is crucial to prioritize the payment of your AWS invoices to avoid these potential consequences. By maintaining a good payment history, you can protect your credit score and financial reputation.

Credit: www.uschamber.com

Navigating Unpaid Aws Invoices

When it comes to managing your AWS account, it’s crucial to stay on top of your invoices to avoid any potential impact on your credit. Navigating unpaid AWS invoices requires a proactive approach to resolve outstanding payments and implement preventative measures for future billing.

Steps To Resolve Unpaid Invoices

Resolving unpaid AWS invoices is essential to maintain a positive credit status and ensure uninterrupted access to AWS services. Follow these steps to address any outstanding payments:

- Review the invoice details and verify the outstanding amount.

- Contact AWS customer support to discuss the unpaid invoice and explore potential payment arrangements or options.

- Initiate the payment process through the AWS billing portal or designated payment channels.

- Monitor the status of the payment and ensure the outstanding amount is cleared promptly.

Preventative Measures For Future Billing

Implementing preventative measures can help mitigate the risk of unpaid AWS invoices and maintain a positive billing history. Consider the following strategies to safeguard against future billing issues:

- Set up billing alerts and notifications to receive timely reminders about upcoming invoice due dates and payment deadlines.

- Regularly review your AWS usage and associated costs to identify any potential discrepancies or unexpected charges.

- Utilize budgeting tools and cost management features offered by AWS to track and control your spending effectively.

- Engage in proactive communication with AWS customer support to address any billing-related queries or concerns promptly.

Legal And Collection Processes

Unpaid AWS invoices can potentially affect your credit score, as they may be reported to credit bureaus. It is important to understand the legal and collection processes involved in resolving unpaid invoices to avoid any negative impact on your credit.

Aws’s Collection Strategy

In cases of unpaid invoices, AWS follows a systematic collection strategy to recover outstanding payments. They may send reminders, escalate communication, and eventually resort to legal action if necessary.Legal Recourse For Unpaid Invoices

When faced with persistent non-payment, AWS has legal options to pursue resolution. They may involve debt collection agencies, file lawsuits, or place liens on assets to secure payment. In the event of unpaid AWS invoices, legal and collection processes come into play. AWS implements a structured strategy for collection, utilizing reminders and escalation before considering legal action. For unresolved cases, legal recourse can involve debt collection agencies, lawsuits, and liens on assets.

Credit: www.pillarcatholic.com

Protecting Your Credit

Unpaid AWS invoices can impact your credit score. It’s crucial to safeguard your credit standing from any negative repercussions.

Monitoring Credit Reports

Regularly check your credit reports to catch any discrepancies early.

Dispute Resolution For Incorrect Claims

- Contact AWS to resolve any billing errors promptly.

- Provide documentation to support your dispute.

Conclusion: Best Practices For Aws Billing

Implementing best practices for AWS billing is crucial to avoid any potential impact on your credit. By following these guidelines, AWS users can effectively manage their invoices and protect their financial standing.

Key Takeaways For Aws Users

- Regularly monitor your AWS usage and billing statements.

- Set up billing alerts to stay informed about your expenses.

- Optimize your resources to reduce unnecessary costs.

Final Thoughts On Credit Protection

- Unpaid AWS invoices can indirectly affect your credit through collection agencies.

- Adopting proactive billing practices can safeguard your credit rating.

- Seek assistance from AWS support if facing billing challenges.

Frequently Asked Questions

What Will Happen If I Didn’t Pay My Aws Bill?

If you don’t pay your AWS bill, your account will be suspended and you won’t be able to access your resources. After a certain period of time, AWS will terminate your resources and delete your data. It’s important to pay your bill on time to avoid any disruptions to your service.

What Happens After Aws Suspends An Account Due To Non-payment Of The Bill?

After AWS suspends an account due to non-payment, services will be interrupted. To restore, pay the bill and contact AWS support for reactivation.

Can I Close My Aws Account Without Paying The Bill?

No, you cannot close your AWS account without paying the bill. AWS will charge you for any usage or services you have used before closing the account. You must clear all dues and balances to avoid any complications.

How Long Do I Have To Pay My Aws Bill?

You have a specific due date to pay your AWS bill, typically within 30 days.

Conclusion

It’s clear that unpaid AWS invoices can impact your credit score. Managing your invoices promptly is crucial to safeguarding your financial standing. By staying proactive and organized, you can prevent any negative repercussions and maintain a healthy credit profile. Stay on top of your AWS billing to protect your creditworthiness.