To go from awful credit to good credit, start by paying bills on time and reducing credit card balances. Improve your credit score by disputing errors on your credit report and avoiding new credit applications.

Repairing your credit takes time and discipline, but the effort is well worth it. By following some proven strategies, you can gradually rebuild your credit and improve your financial prospects. Whether you want to qualify for better loan rates or simply gain peace of mind, achieving good credit is an achievable goal with the right approach.

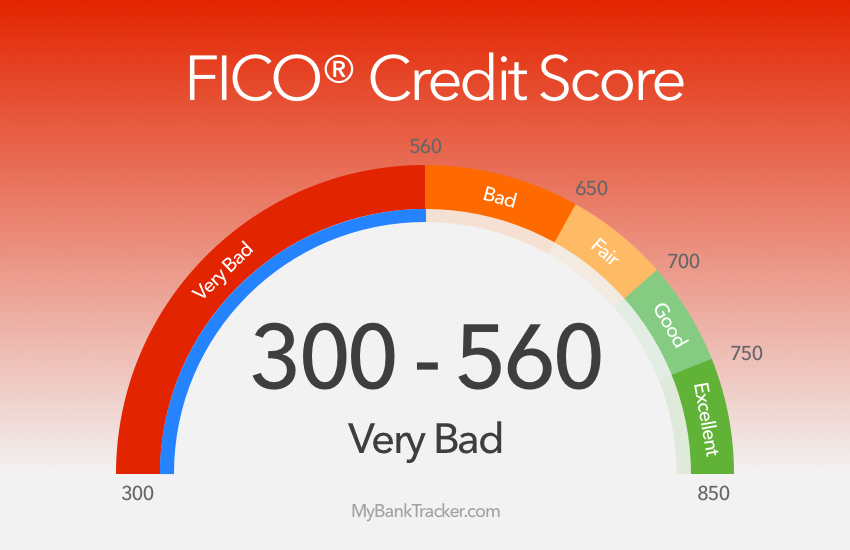

Credit: www.mybanktracker.com

The Impact Of Credit Scores On Financial Health

Boost your financial health by transitioning from poor credit to a strong credit score. Elevate your creditworthiness through smart financial habits and timely payments. Improve your chances of securing loans and better interest rates with a healthy credit profile.

Why Good Credit Matters

Having good credit is crucial for maintaining a healthy financial life. Your credit score is a numerical representation of your creditworthiness, and it plays a significant role in determining whether lenders will approve your loan applications, credit card applications, or even your rental applications. A good credit score demonstrates your ability to manage credit responsibly, making you a more attractive borrower to lenders.

With good credit, you have access to lower interest rates, which can save you thousands of dollars over time. It allows you to qualify for better credit card rewards, secure favorable terms on loans, and obtain lower insurance premiums. Good credit also opens doors to more opportunities, such as renting an apartment or getting a mortgage, as landlords and lenders often rely on credit scores to assess your financial stability.

Consequences Of Poor Credit

Poor credit can have severe consequences on your financial health. When your credit score is low, it becomes challenging to secure new credit or loans. Lenders may consider you a high-risk borrower, making it difficult to qualify for favorable interest rates or even get approved at all.

Furthermore, poor credit can lead to higher interest rates on loans, credit cards, and mortgages. This means you end up paying more in interest charges, which can significantly impact your monthly budget. It becomes harder to achieve your financial goals, such as buying a car, purchasing a home, or starting a business.

In addition to the financial implications, poor credit can also affect your personal life. Landlords may be hesitant to rent to you, and employers could take your credit history into account during the hiring process. This can limit your housing options and job prospects, adding stress to your everyday life.

Assessing Your Credit Situation

If you have a poor credit score, it’s important to take action to improve it. The first step is to assess your credit situation. This involves getting your credit report and understanding your credit score.

Getting Your Credit Report

Your credit report is a detailed summary of your credit history. It includes information about your credit accounts, such as credit cards, loans, and mortgages, as well as your payment history, balances, and credit limits.

To get your credit report, you can request a free copy from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to one free credit report per year from each bureau.

Once you have your credit report, review it carefully to ensure that all the information is accurate. If you find any errors, you can dispute them with the credit bureau to have them corrected.

Understanding Your Credit Score

Your credit score is a three-digit number that represents your creditworthiness. The higher your credit score, the more likely you are to be approved for credit and to receive favorable interest rates.

The most commonly used credit score is the FICO score, which ranges from 300 to 850. A score of 700 or above is generally considered good, while a score below 600 is considered poor.

To improve your credit score, you need to understand the factors that affect it. These include your payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries.

By assessing your credit situation and taking steps to improve it, you can go from having awful credit to good credit over time.

Strategies For Debt Management

When it comes to improving your credit, effective debt management is key. By implementing smart strategies, you can pave the way towards a healthier financial future. Let’s explore some actionable steps to help you go from awful credit to good credit through effective debt management.

Creating A Debt Repayment Plan

Start by assessing your current debt situation. List all your outstanding balances, interest rates, and monthly payments. Prioritize high-interest debts to save on interest payments. Consider using the snowball or avalanche method to tackle your debts. The snowball method involves paying off the smallest debts first, while the avalanche method focuses on the highest interest debts.

Negotiating With Creditors

If you’re struggling with high monthly payments, reach out to your creditors to negotiate more manageable terms. This could involve requesting lower interest rates, extended payment terms, or even a settlement offer. Clearly explain your financial hardship and propose a realistic payment plan. Be proactive in finding a solution that works for both parties.

Credit: www.incharge.org

Improving Payment Habits

Looking to improve your credit score? Learn how to go from awful credit to good credit by adopting better payment habits. Follow these steps to take control of your finances and start rebuilding your credit today.

Setting Up Payment Reminders

Managing your finances can be overwhelming, especially when you have bad credit. However, improving your payment habits is one of the most significant steps you can take towards achieving a good credit score. Setting up payment reminders can help you keep track of your bills and avoid missing payments. This way, you can avoid late fees and negative marks on your credit report, which can hurt your credit score.Automating Payments

Automating your payments is another helpful way to improve your payment habits. This option allows you to set up automatic payments for your bills, so you don’t have to worry about missing a payment. You can choose to automate your payments for various bills, such as your credit card, utilities, and loans. By doing so, you can ensure that each bill is paid on time, which can positively impact your credit score. Improving your payment habits is crucial to achieving a good credit score. Setting up payment reminders and automating your payments are two effective ways to help you achieve this goal. By doing so, you can avoid missed payments, late fees, and negative marks on your credit report. Remember, improving your credit score takes time and effort, but with the right habits and strategies, you can achieve financial stability and peace of mind.Building A Strong Credit History

Building a strong credit history is crucial for financial stability. To go from awful credit to good credit, start by paying bills on time, reducing credit card balances, disputing errors on credit reports, limiting new credit applications, and using credit responsibly.

With patience and diligence, it’s possible to improve credit and achieve financial goals.

Using Credit Cards Wisely

One of the key elements in building a strong credit history is using credit cards wisely. When it comes to credit cards, it’s important to understand that they can be both a valuable tool and a potential liability. By following a few simple guidelines, you can make sure that your credit card usage works in your favor.

Pay your bills on time: One of the most important factors in building good credit is making your credit card payments on time. Late payments can have a negative impact on your credit score, so it’s crucial to develop a habit of paying your bills promptly.

Avoid maxing out your credit cards: Utilizing too much of your available credit can be seen as a sign of financial instability. It’s generally recommended to keep your credit card balance below 30% of your credit limit. This demonstrates responsible credit usage and can help improve your credit score.

Keep your oldest credit cards open: The length of your credit history plays a significant role in determining your creditworthiness. If you have an older credit card that you no longer use, it may be tempting to close the account. However, keeping it open can help boost your credit score by showing a longer credit history.

Benefits Of A Secured Credit Card

If you have a poor credit history or no credit at all, a secured credit card can be a great tool for building a strong credit history. Unlike a traditional credit card, a secured card requires a cash deposit that serves as collateral. Here are some benefits of using a secured credit card:

- Opportunity to establish credit: Secured credit cards are often easier to obtain than traditional credit cards, making them an excellent option for those with poor credit or limited credit history. By using a secured credit card responsibly, you can start building a positive credit history.

- Gradual credit limit increases: Some secured credit card providers offer the opportunity for your credit limit to increase over time. By consistently making on-time payments and demonstrating responsible credit usage, you may be eligible for a higher credit limit, which can improve your credit score.

- Protection against overspending: Since a secured credit card requires a cash deposit, you can only spend up to the amount you have deposited. This helps prevent overspending and allows you to manage your credit utilization effectively.

Credit: www.teachernextdoor.us

Credit Repair And Dispute Handling

Improve your credit from awful to good with expert credit repair and dispute handling. Our proven strategies help you challenge inaccurate items on your credit report and rebuild your credit score. With our guidance, you can take control of your financial future and achieve the good credit you deserve.

Identifying Errors On Your Credit Report

Review your credit report regularly for any mistakes.

Look for inaccuracies in personal information and account details.

Filing Disputes With Credit Bureaus

Contact the credit bureaus to dispute errors in writing.

Provide evidence to support your dispute claims.

Credit repair starts with recognizing and rectifying errors on your credit report. Regularly check for inaccuracies in personal information and account details. When disputing errors with credit bureaus, ensure to contact them in writing and provide supporting evidence to strengthen your claims.Monitoring And Protecting Your Credit

When it comes to improving your credit score, monitoring and protecting your credit are crucial steps.

Regularly Checking Your Credit Score

Check your credit score monthly to track changes.

Guarding Against Identity Theft

- Shred sensitive documents to protect personal information.

- Set up fraud alerts to monitor any suspicious activities.

Maintaining Good Credit Long-term

To maintain good credit long-term, it’s crucial to start by addressing your outstanding debts and making payments on time. Keep your credit utilization low and monitor your credit report for errors or fraudulent activity. Stay disciplined with your spending and avoid applying for new credit unnecessarily.

With consistency and patience, you can improve your credit score and maintain good credit for years to come.

Adopting Healthy Financial Behaviors

Consistently pay bills on time to avoid late fees and negative marks on credit report.

Limit credit card usage to 30% of available credit to prevent high utilization rates.

Regularly monitor credit report for errors and suspicious activities.

Continuous Learning And Adaptation

Stay updated on changes in credit scoring criteria and adjust financial habits accordingly.

Seek advice from financial advisors or credit counseling services for guidance when needed.

Educate yourself on effective debt management strategies to maintain healthy credit.

Frequently Asked Questions

Can You Turn Bad Credit Into Good Credit?

Yes, you can improve bad credit and turn it into good credit. By making timely payments, reducing debt, and managing credit responsibly, you can gradually improve your credit score over time. It’s important to be patient and consistent in your efforts to rebuild your credit.

Is It Possible To Go From Poor To Excellent Credit Score?

Yes, it is possible to go from a poor credit score to an excellent one. By practicing good financial habits such as paying bills on time, reducing debt, and keeping credit card balances low, you can gradually improve your credit score over time.

Consistency and responsible credit management are key.

How Long Does It Take To Go From Bad Credit To Excellent Credit?

Improving credit from bad to excellent can take 1-2 years with consistent, responsible financial habits. Timely payments, reducing debt, and regular credit monitoring can help speed up the process.

What Is The Fastest Way To Rebuild Bad Credit?

The fastest way to rebuild bad credit is to pay bills on time, reduce debt, and check credit reports for errors. Also, consider using a secured credit card or becoming an authorized user on someone else’s credit card. Regularly monitoring credit scores and being patient are crucial.

Conclusion

Improving your credit score takes time and effort. By managing your finances responsibly and making timely payments, you can gradually rebuild your credit. Remember to regularly check your credit report for errors and take steps to address them. With patience and determination, you can go from awful credit to good credit.