The AWS (Authorization, Warranting, and Settlement) on credit cards refers to the process of verifying, authorizing, and completing a credit card transaction. It is a crucial step in ensuring the security and validity of credit card payments.

Credit card transactions involve the AWS process, which includes authorization, warranting, and settlement. This process is essential for validating and processing credit card payments securely. Understanding the AWS on credit cards is vital for businesses and consumers alike, as it directly impacts the efficiency and security of financial transactions.

By comprehending the intricacies of the AWS process, businesses can streamline their payment procedures and enhance customer satisfaction. Moreover, consumers can have confidence in the security and reliability of their credit card transactions. In this blog, we will delve into the details of the AWS on credit cards, exploring its significance and implications in the realm of financial transactions.

Credit: knowledge.broadcom.com

The Enigma Of Aws On Credit Card Statements

Have you ever come across the abbreviation “AWS” on your credit card statement and wondered what it stands for? The mysterious acronym can leave cardholders perplexed, especially if they don’t recall making any purchases related to Amazon Web Services (AWS). In this blog post, we will delve into the enigma of AWS on credit card statements and shed light on its meaning and common scenarios leading to AWS charges.

Deciphering The Aws Abbreviation

When you see “AWS” on your credit card statement, it refers to Amazon Web Services. AWS is a comprehensive cloud computing platform offered by Amazon. It provides a wide range of cloud-based services to individuals, businesses, and organizations worldwide. These services include storage, databases, analytics, machine learning, networking, and more. Many businesses and individuals utilize AWS to host websites, run applications, store data, and perform various computing tasks in the cloud.

Common Scenarios Leading To Aws Charges

There are several common scenarios that may result in AWS charges appearing on your credit card statement. Let’s explore a few of them:

- Web Hosting: If you have a website or a web application hosted on AWS, you may see charges related to the usage of AWS resources such as storage, bandwidth, and compute power.

- Cloud Storage: AWS offers scalable and secure cloud storage solutions. If you utilize services like Amazon S3 (Simple Storage Service) to store and retrieve your data, the charges for storage usage will be reflected on your credit card statement.

- Compute Services: AWS provides various compute services, such as Amazon EC2 (Elastic Compute Cloud), which allows you to run virtual servers in the cloud. If you use these services, you may incur charges for the compute resources consumed.

- Database Services: AWS offers managed database services like Amazon RDS (Relational Database Service) and Amazon DynamoDB. If you use these services to store and manage your data, the charges for database usage will be included in your credit card statement.

- Additional Services: AWS offers a vast array of additional services, including analytics, machine learning, networking, content delivery, and more. Depending on your usage of these services, you may see corresponding charges on your credit card statement.

It’s important to review your AWS usage regularly to understand the specific services you are utilizing and the associated charges. By monitoring your AWS usage, you can ensure that the charges on your credit card statement align with your expectations and usage requirements.

Next time you spot “AWS” on your credit card statement, you’ll know that it refers to Amazon Web Services. Familiarize yourself with the common scenarios leading to AWS charges to gain a better understanding of your cloud computing expenses.

Credit: aws.amazon.com

Tracing The Origins Of Aws Charges

Subscription Services And Trials

When signing up for a credit card, it’s common for individuals to be enticed by subscription services and trials. These offers may seem appealing initially, but they can lead to unexpected charges from Amazon Web Services (AWS) in the long run. It’s important to carefully monitor the terms and conditions of these services to avoid any unforeseen fees.

Unexpected Renewals And Upgrades

Unexpected renewals and upgrades are potential sources of AWS charges on credit cards. It’s crucial to keep track of any automatic renewals or upgrades associated with AWS accounts, as they can result in additional costs. Regularly reviewing subscription plans and monitoring usage can help prevent these surprise charges.

Differentiating Between Aws Cloud Services And Other Aws Charges

When reviewing credit card statements, differentiate between AWS cloud services charges and other fees to understand billing details accurately. Identify AWS charges easily by checking for specific service names and transaction descriptions on your credit card statement. Understanding these distinctions can help you manage your AWS expenses effectively.

Differentiating Between AWS Cloud Services and Other AWS Charges When it comes to AWS on credit cards, it’s important to understand the different types of charges that may appear on your bill. One area that can be particularly confusing is distinguishing between AWS cloud services and other AWS charges. In this post, we’ll take a closer look at these two categories and how they differ. AWS Cloud Computing Costs AWS cloud computing costs refer to charges for using AWS services such as EC2, S3, and RDS. These charges are typically based on usage, with customers paying for the resources they consume. For example, EC2 charges are based on the number of hours a customer uses an instance, while S3 charges are based on the amount of data stored. Miscellaneous AWS Charges In addition to cloud computing costs, AWS bills may also include miscellaneous charges for other services or features. These charges can include things like support plans, reserved instance fees, and data transfer fees. It’s important to carefully review your bill to understand these charges and ensure they are accurate. To help differentiate between these two categories, here is a table summarizing the key differences:| Category | Description |

|---|---|

| AWS Cloud Computing Costs | Charges for using AWS services such as EC2, S3, and RDS, based on usage |

| Miscellaneous AWS Charges | Charges for other services or features, such as support plans, reserved instance fees, and data transfer fees |

Identifying Legitimate Vs. Fraudulent Aws Charges

With the increasing use of AWS on credit cards, it is crucial to distinguish between legitimate and fraudulent charges. By identifying suspicious activities and regularly monitoring your account, you can protect yourself from unauthorized charges and ensure the security of your financial information.

Identifying Legitimate vs. Fraudulent AWS Charges When it comes to managing credit card expenses, it’s important to keep an eye out for any unauthorized charges. This is especially important when dealing with cloud services like Amazon Web Services (AWS). As a business owner or individual using AWS, it’s crucial to be able to identify legitimate charges and red flags for fraudulent transactions. In this post, we’ll discuss the signs of legitimate charges and red flags for fraudulent transactions to ensure you’re only paying for the services you’re actually using.Signs Of Legitimate Charges

Legitimate AWS charges will generally be consistent and predictable. For instance, if you’re signed up for a particular AWS service that charges a flat monthly fee, you should see that charge on your credit card bill every month. Additionally, you can expect to see charges for any usage-based services that you’ve used during the billing period. These charges will be based on the usage and the rate for that particular service.Red Flags For Fraudulent Transactions

Unfortunately, fraudulent charges can happen to anyone. But knowing what to look for can help you identify and report these charges quickly. Some common red flags for fraudulent AWS charges include:- Charges for services you don’t recognize or didn’t sign up for

- Charges for services that you’ve never used before

- Multiple charges for the same service or different services from the same vendor

- Charges for services that are significantly higher than what you normally pay

- Charges from vendors that you’ve never heard of or don’t do business with

Steps To Resolve Unwanted Aws Charges

Unwanted charges on your AWS (Amazon Web Services) account can be a frustrating experience. However, there are steps you can take to resolve these charges and ensure that you are only paying for the services you have actually used. In this article, we will outline three key steps to help you resolve unwanted AWS charges: contacting AWS support, disputing charges with your credit card issuer.

Contacting Aws Support

If you notice any unexpected charges on your AWS account, it is essential to reach out to AWS support as soon as possible. Follow these steps to contact AWS support:

- Log in to your AWS Management Console.

- Click on the “Support” tab in the upper-right corner of the console.

- Choose the support plan that best suits your needs.

- Select the “Create Case” button to open a new support case.

- Provide detailed information about the unwanted charges and any relevant supporting documentation.

- Submit the case and await a response from AWS support.

Disputing Charges With Your Credit Card Issuer

If you have been unable to resolve the unwanted AWS charges through AWS support, you may need to dispute the charges with your credit card issuer. Follow these steps to initiate the dispute process:

- Contact your credit card issuer’s customer service department using the number on the back of your credit card.

- Explain the situation and provide any evidence you have regarding the unwanted charges.

- Request that the charges be investigated and potentially reversed.

- Follow any additional instructions provided by your credit card issuer.

Resolving unwanted AWS charges can be a time-consuming process, but by following these steps and taking prompt action, you can increase your chances of a successful resolution. Remember to monitor your AWS account regularly to catch any unauthorized charges early and take appropriate action.

Preventive Measures To Avoid Future Aws Surprises

To avoid future AWS surprises on credit cards, it’s important to take preventive measures. This includes regularly monitoring your AWS usage, setting up spending limits and alerts, and using IAM roles to control access to your AWS resources. By taking these steps, you can avoid unexpected charges and keep your AWS costs under control.

Setting Budget Alerts

Set up budget alerts to monitor spending proactively.

Receive notifications before exceeding limits.

Regularly Reviewing Aws Accounts And Subscriptions

Review accounts and subscriptions frequently for accuracy.

Ensure no unused resources are being billed.

Understanding The Role Of Aws In Today’s Digital Economy

AWS (Amazon Web Services) is a cloud computing platform that offers various services such as storage, computing power, and databases. It has become an essential part of the digital economy, including credit card processing, due to its scalability, flexibility, and cost-effectiveness.

Aws’s Impact On Business Operations

AWS revolutionizes business operations through efficient cloud services.

Why Aws Charges Appear Frequently On Statements

Understanding why AWS charges show up often is crucial.

Navigating Through Aws Billing And Account Management

Managing your AWS billing and account is essential for effective cost control. By understanding how to navigate through AWS billing and account management, you can optimize your usage and expenses efficiently.

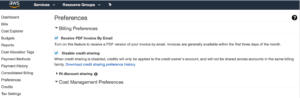

Utilizing The Aws Management Console

Access the AWS Management Console to monitor your usage and billing information. This user-friendly interface provides a comprehensive overview of your account details.

Leveraging Aws Cost Management Tools

Utilize AWS cost management tools to analyze your spending patterns and identify cost-saving opportunities. These tools offer insights to optimize your AWS resources effectively.

Credit: m.youtube.com

Frequently Asked Questions

How Do I Stop Aws From Charging My Card?

To stop AWS from charging your card, go to your account settings and disable automatic billing. Keep an eye on your usage and set up billing alerts for added control.

What Is Aws On My Bank Statement?

AWS on your bank statement refers to Amazon Web Services, a cloud computing platform offered by Amazon. It provides various services such as storage, computing power, and database management. If you see AWS on your bank statement, it means you have made a payment for using these services.

How Much Is 1 Aws Credit Worth?

The value of 1 AWS credit varies depending on the service used. It ranges from $0. 05 to $0. 10 per credit.

What Is A Credit In Aws?

A credit in AWS refers to a unit of measurement for certain services that are charged on an hourly basis. It allows users to access and utilize AWS resources within a specific limit without incurring additional charges.

Conclusion

Understanding the concept of AWS on credit cards is crucial for making informed financial decisions. By comprehending the benefits and drawbacks, individuals can better manage their credit card usage. With proper knowledge, they can take advantage of rewards, protect themselves from potential risks, and maintain a healthy financial standing.

Stay informed and make wise choices to ensure a positive credit card experience.