Yes, you can use a credit card to invest in AWS. In doing so, you can take advantage of the potential benefits and returns that AWS offers for your investment.

By using a credit card, you can easily fund your investment in AWS services and start building your portfolio. AWS provides various investment options, such as buying shares or investing in AWS-related projects and services. This allows individuals and businesses to participate in the growth and success of AWS while utilizing the convenience of using a credit card for their investments.

With this approach, you can potentially earn profits and diversify your investment portfolio.

Credit: www.nojitter.com

Introduction To Credit Card Investments

Credit cards can be used to invest in AWS, offering a convenient way to access the stock market. By using a credit card for investment, individuals can potentially earn rewards and build their investment portfolio. However, it’s important to carefully manage risks and consider the potential impact on personal finances.

Investing in Amazon Web Services (AWS) using a credit card can be a convenient way to access potential returns. Let’s delve into the concept of credit card investments and explore its benefits and drawbacks.The Surge Of Credit As An Investment Tool

In recent years, more individuals are turning to credit cards as a means to invest in various assets, including stocks and cryptocurrencies. The ease of access and instant purchasing power make credit cards an appealing option for those looking to enter the investment realm.Pros And Cons Of Using Credit For Investments

| Pros | Cons |

|

|

Understanding Aws As An Investment

Amazon Web Services (AWS) is a cloud computing platform that provides a range of services, including computing power, storage, and databases, to businesses and individuals. As cloud computing becomes increasingly important for businesses, AWS has become a popular investment opportunity for those looking to invest in the technology sector. In this article, we will discuss AWS’s role in cloud computing and the potential returns from investing in AWS.

Aws’s Role In Cloud Computing

Cloud computing has become an essential part of modern business operations, allowing companies to store and access data and applications over the internet. AWS is one of the leading cloud computing providers, offering a range of services that enable businesses to scale their operations and reduce costs. AWS’s services include:

| Service | Description |

|---|---|

| Compute | Provides virtual servers, containers, and functions that allow businesses to run applications and workloads without the need for physical hardware. |

| Storage | Provides scalable and durable storage solutions that allow businesses to store and retrieve data from anywhere in the world. |

| Database | Provides a range of managed database services, including SQL and NoSQL databases, that allow businesses to store and manage their data efficiently. |

With AWS’s services, businesses can easily and cost-effectively deploy and manage their applications and workloads, making it a popular choice for businesses of all sizes.

Potential Returns From Investing In Aws

Investing in AWS can provide investors with a range of potential returns. As AWS continues to grow and expand its services, investors can benefit from the company’s increasing revenue and profits. In addition, AWS’s dominance in the cloud computing market makes it a relatively safe investment option for those looking to invest in the technology sector.

According to a report by Synergy Research Group, AWS has a 33% share of the cloud infrastructure market, making it the market leader by a significant margin. This dominance provides AWS with a competitive advantage and a strong position for future growth.

Furthermore, AWS’s revenue has been steadily increasing over the years, with the company reporting $45.4 billion in revenue in 2020, up from $35 billion in 2019. This growth is expected to continue as more businesses adopt cloud computing, providing investors with a potentially lucrative investment opportunity.

In conclusion, investing in AWS can be a smart investment choice for those looking to invest in the technology sector. With its dominance in the cloud computing market and strong revenue growth, AWS offers investors a range of potential returns.

Credit Cards And Aws: The Connection

In today’s digital age, businesses are increasingly turning to cloud computing services like Amazon Web Services (AWS) to streamline operations and drive innovation. However, many entrepreneurs and small business owners may wonder if they can use their credit cards to invest in AWS. Let’s explore the potential implications of using credit cards to fund AWS services and the impact on your financial health.

Using A Credit Card To Fund Aws Services

Entrepreneurs and businesses can use credit cards to fund their AWS services, providing a convenient and flexible payment option. This method enables quick access to the powerful suite of AWS tools and resources, allowing businesses to scale their operations efficiently.

Impact On Credit Score And Financial Health

When using a credit card to invest in AWS, it’s essential to consider the potential impact on your credit score and overall financial health. Careful management of credit card utilization and timely payments is crucial to avoid negative effects on credit scores and financial well-being.

Analyzing The Smart Strategy Angle

Investing in AWS with a credit card is a smart strategy worth analyzing. By carefully evaluating the potential risks and rewards, individuals can leverage their credit to enter the world of AWS investments. It opens up opportunities for growth and diversification in the digital landscape.

Leveraging Credit For Growth

When it comes to investing in AWS, it’s important to consider all your financing options. One option that some investors may overlook is using credit cards. While it’s not the most conventional method, leveraging credit for growth can be a smart strategy. Using a credit card to invest in AWS can offer several benefits. Firstly, credit cards typically have a higher credit limit than personal loans or lines of credit, which means you can invest more money at once. Secondly, many credit cards offer rewards such as cashback or travel points, which can further boost your investment returns. However, it’s important to note that using credit cards to invest also comes with risks.Risk Versus Reward In Credit Financing

One of the biggest risks of using credit cards to invest is the high-interest rates. Credit card interest rates can be as high as 20% or more, which means if you can’t pay off your balance in full each month, you’ll end up paying much more in interest than you earn in returns. Another risk is the potential impact on your credit score. Using too much of your available credit can hurt your credit utilization ratio, which is a key factor in determining your credit score. That being said, if you’re able to pay off your balance in full each month and use credit responsibly, the rewards can outweigh the risks. Just make sure to do your research and consider all your options before making any investment decisions. In conclusion, while using credit cards to invest in AWS can be a smart strategy, it’s important to weigh the risks versus rewards and make sure you’re using credit responsibly.Credit Card Rewards And Aws Investment

Investing in AWS with a credit card is not possible. However, credit card rewards can be used to purchase AWS credits which can then be used for investment. This approach can potentially earn rewards points and also help with AWS investment.

Maximizing Cashback And Points

If you’re considering investing in AWS, it’s worth exploring how credit card rewards can enhance your investment strategy. Many credit cards offer cashback or rewards points for every dollar spent, and this can be a valuable tool for maximizing your investment potential.

By choosing a credit card that offers generous cashback or rewards on purchases, you can earn money or points simply by using your card to invest in AWS. This can be particularly advantageous if you plan on making significant investments, as the rewards can quickly add up.

When selecting a credit card for this purpose, look for one that offers high cashback rates or rewards points on general purchases, as well as specific categories that align with your AWS investment needs. This will allow you to make the most of your spending and earn even more rewards.

Aligning Rewards With Aws Spending

Another way to maximize the benefits of credit card rewards when investing in AWS is by aligning your rewards with your AWS spending. Many credit cards offer bonus rewards or higher cashback rates on specific categories, such as technology or online purchases.

By using a credit card that offers enhanced rewards on these categories, you can earn even more cashback or points when investing in AWS. This strategic alignment allows you to make the most of your credit card rewards program and boost your investment returns.

When choosing a credit card, check if it offers bonus rewards on technology or online purchases. This will ensure that you earn additional rewards every time you invest in AWS, ultimately maximizing the value of your credit card rewards.

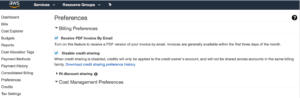

Credit: aws.amazon.com

Financial Prerequisites For Credit Investment

Before using a credit card to invest in AWS, it’s crucial to consider the financial prerequisites for credit investment. This includes evaluating the credit limit considerations and understanding the implications of interest rates.

Credit Limit Considerations

Assessing your credit card’s limit is essential before investing in AWS. Ensure that your available credit is sufficient for the investment amount, avoiding overutilization and potential penalties.

Interest Rates And Their Implications

Understanding the interest rates associated with your credit card is imperative. High-interest rates can significantly impact the overall cost of investment, potentially eroding potential gains. Consider the long-term implications of interest rates on investment returns.

Real-life Examples And Case Studies

Success Stories Of Credit-funded Aws Investments

Investors have leveraged credit cards to fund their AWS ventures successfully.

One entrepreneur used a credit card to launch their startup on AWS, leading to rapid growth.

Another investor saw substantial returns after using a credit card to expand AWS resources.

Cautionary Tales And Lessons Learned

Some individuals faced challenges when investing in AWS with credit cards.

One cautionary tale involves accumulating high-interest debt due to credit-funded AWS investments.

Lessons learned include the importance of managing credit responsibly when investing in AWS.

Alternative Financing Options For Aws

Comparing Credit Cards With Other Investment Methods

When exploring financing options for AWS, considering alternatives is crucial.

Strategic Partnerships And Venture Capital

Collaborating with strategic partners or seeking venture capital can be beneficial.

The Legal And Ethical Aspects

Using a credit card to invest in AWS raises legal and ethical considerations. It’s essential to consider the terms and conditions of the credit card company, as well as potential financial risks. Additionally, understanding the ethical implications of using borrowed funds for investment is crucial.

Understanding The Fine Print

Before using a credit card to invest in AWS, carefully read the terms and conditions.

Understand interest rates, fees, and potential risks involved in leveraging credit for investments.

Ethics Of Using Credit For Investment

Consider the ethical implications of using borrowed money to invest in AWS.

Ensure you are comfortable with the risks and responsibilities associated with this decision.

Credit: thehustle.co

Conclusion And Future Outlook

The strategy of using credit cards to invest in AWS can be viable.

Summarizing The Viability Of The Strategy

It is a high-risk strategy with potential for significant returns.

Ensure careful management of credit utilization and payments.

Predictions For Credit Use In Cloud Investments

- Rise in individuals leveraging credit for cloud investments.

- Increased availability of credit options tailored for tech investments.

- Regulations evolving to address credit use in cloud services.

Frequently Asked Questions

Does Aws Accept Credit Cards?

Yes, AWS accepts credit cards as a payment method for their services.

Can We Buy In Amazon Using Credit Card?

Yes, you can buy on Amazon using a credit card. Simply add it as a payment method during checkout.

Is It Ok To Use Credit Card On Amazon?

Yes, it is perfectly fine to use a credit card on Amazon. It is a secure and trusted platform for online shopping. Your credit card information is encrypted and protected, ensuring a safe transaction. Enjoy the convenience of using your credit card to make purchases on Amazon.

How Do You Pay For Aws?

You can pay for AWS using various methods like credit card, bank transfer, or through services like Amazon Payments. Simply set up your preferred payment method in the AWS Billing and Cost Management console.

Conclusion

In sum, using a credit card to invest in AWS can be a convenient option for some. However, it’s crucial to consider the potential risks and fees involved. Before proceeding, individuals should conduct thorough research and seek professional financial advice.

Making informed decisions is essential for successful investment strategies.