To fix an awful credit score, focus on paying off outstanding debts and making payments on time. This will gradually improve your credit score and help you regain financial stability.

If you’re struggling with a poor credit score, it’s essential to take proactive steps to rectify the situation. By addressing outstanding debts and making timely payments, you can slowly rebuild your creditworthiness. This article will provide you with practical tips and strategies to fix your credit score, enabling you to regain control of your financial future.

Whether you’re recovering from past mistakes or facing unexpected financial challenges, implementing these measures can help you improve your credit score and open up new opportunities for financial success.

Credit: www.experian.com

Introduction To Credit Scores

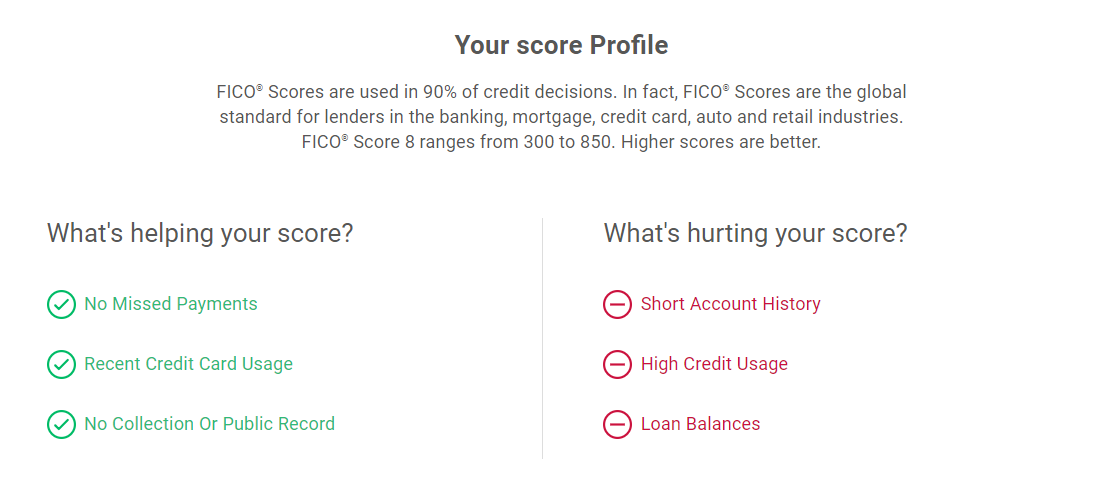

Credit scores play a crucial role in your financial health. Understanding the basics of credit scores is the first step towards improving your financial standing. Your credit score impacts your ability to borrow money and the interest rates you receive. Let’s delve into the fundamental aspects of credit scores.

The Impact Of A Bad Credit Score

A poor credit score can limit your access to loans and credit cards. It can result in higher interest rates and unfavorable terms. Lenders use credit scores to assess your creditworthiness.

Key Components Of Your Credit Score

- Payment history – Timely payments are crucial.

- Credit utilization – Keep your credit card balances low.

- Length of credit history – Longer history can boost your score.

- New credit – Avoid opening multiple accounts at once.

- Credit mix – Having a diverse mix of credit types is beneficial.

Identifying The Causes Of Poor Credit

Identifying the causes of poor credit is the first step towards improving your credit score. It is essential to understand the factors that have led to the poor credit score so that you can take the necessary steps to fix it. In this article, we will discuss the common causes of poor credit and ways to address them.

Common Credit Report Errors

One of the most common causes of poor credit is errors on your credit report. Credit report errors can occur due to various reasons such as incorrect information, identity theft, or outdated data. It is important to review your credit report regularly to identify any errors and dispute them with the credit bureaus.

Habits That Hurt Your Credit Score

Another common cause of poor credit is the habits that hurt your credit score. Late payments, maxing out credit cards, and opening too many new accounts are some of the habits that can negatively impact your credit score. It is important to develop good credit habits such as paying your bills on time, keeping your credit utilization low, and avoiding unnecessary credit applications.

By identifying the causes of poor credit, you can take the necessary steps to improve your credit score. Whether it is disputing errors on your credit report or developing good credit habits, it is essential to take proactive measures to fix your credit score and achieve financial stability.

Initial Steps To Repair Credit

If you’re struggling with a poor credit score, taking the initial steps to repair your credit is crucial in regaining financial stability. By understanding how to obtain your credit report and disputing any inaccuracies, you can lay the foundation for improving your creditworthiness.

Obtaining Your Credit Report

To begin the credit repair process, obtain a copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to one free credit report from each bureau annually, which you can request through AnnualCreditReport.com. Reviewing these reports will give you a comprehensive understanding of your current financial standing and help you identify areas for improvement.

Disputing Credit Report Inaccuracies

Upon obtaining your credit reports, carefully review them for any inaccuracies or errors. Common discrepancies include incorrect account information, unauthorized inquiries, or inaccurate personal details. If you identify any inaccuracies, file a dispute with the credit bureau reporting the error. Provide any supporting documentation to substantiate your claim and follow up to ensure the necessary corrections are made. Disputing these inaccuracies can significantly impact your credit score and pave the way for credit repair.

Debt Management Strategies

If you have an awful credit score, it may be due to overwhelming debt. Fortunately, there are debt management strategies that can help you get back on track. These strategies include creating a debt repayment plan and negotiating with creditors.

Creating A Debt Repayment Plan

One of the most effective ways to manage your debt is by creating a debt repayment plan. This plan should include a list of all your debts, the interest rates, and the minimum monthly payments. Once you have this information, you can prioritize your debts and focus on paying off the ones with the highest interest rates first.

You can also consider consolidating your debts into one loan with a lower interest rate. This can make it easier to manage your payments and reduce your overall interest charges. However, be sure to do your research and compare rates and terms before choosing a consolidation loan.

Negotiating With Creditors

If you’re struggling to make your payments, don’t be afraid to reach out to your creditors and ask for help. Many creditors are willing to work with you to create a payment plan that fits your budget. This can include reducing your interest rates, waiving late fees, or extending your payment due dates.

When negotiating with creditors, it’s important to be honest about your financial situation and to communicate regularly. Make sure you understand the terms of any payment plan before agreeing to it, and be sure to stick to the plan once it’s in place.

Overall, debt management strategies can help you take control of your finances and improve your credit score. By creating a debt repayment plan and negotiating with creditors, you can reduce your debt and work towards a brighter financial future.

Building A Positive Credit History

To fix an awful credit score, focus on building a positive credit history through timely payments and responsible credit use. Keep balances low and open new accounts strategically to improve your credit standing over time. By demonstrating good financial habits, you can gradually repair and enhance your credit score.

Responsible Use Of Credit Cards

One of the key factors in building a positive credit history is the responsible use of credit cards. By using your credit cards wisely, you can demonstrate to lenders that you are capable of managing credit responsibly. Here are some tips to help you make the most of your credit cards:

- Pay your credit card bills on time to avoid late payment fees and negative marks on your credit report.

- Keep your credit card balances low and aim to pay off the full balance each month.

- Avoid opening multiple credit card accounts within a short period as it can negatively impact your credit score.

- Regularly review your credit card statements to detect any unauthorized charges or errors.

Benefits Of Installment Loans

In addition to credit cards, installment loans can also contribute positively to your credit history. Installment loans are loans that are repaid over a fixed period with a set number of scheduled payments. Here are some benefits of using installment loans:

- Demonstrate your ability to manage different types of credit.

- Show lenders your consistency in making timely payments.

- Help diversify your credit mix, which can be beneficial for your credit score.

- Provide an opportunity to build a positive payment history over an extended period.

Building a positive credit history takes time and effort, but by responsibly using credit cards and taking advantage of installment loans, you can gradually improve your credit score. Remember to always make payments on time, keep your balances low, and regularly monitor your credit report for any inaccuracies. By following these steps, you’ll be on your way to achieving a better credit score and opening doors to more financial opportunities.

Credit Improvement Tools

Credit improvement tools can be invaluable in the journey to fix an awful credit score. By utilizing these tools, individuals can make significant strides towards rebuilding their credit and achieving financial stability. Two powerful credit improvement tools are secured credit cards and credit builder loans.

Secured Credit Cards

Secured credit cards are a valuable option for individuals seeking to rebuild their credit. These cards require a cash deposit, which serves as the credit limit. By using a secured credit card responsibly and making timely payments, individuals can demonstrate positive credit behavior, ultimately improving their credit score.

Credit Builder Loans

Credit builder loans offer individuals the opportunity to establish or rebuild their credit. These loans typically involve depositing a specific amount into a savings account, which then becomes the loan amount. As borrowers make regular payments on the loan, their payment history is reported to credit bureaus, leading to potential improvements in their credit score.

Legal And Financial Advice

Looking for ways to improve your credit score? Get legal and financial advice on fixing an awful credit score. Learn how to navigate the complexities of credit repair and take control of your financial future.

Legal and Financial AdviceWhen To Consult A Credit Counselor

Seek help if overwhelmed by debt or can’t manage finances.

Understanding Your Rights Under The Fcra

Know your rights regarding credit report accuracy and privacy.

Credit: www.amazon.com

Maintaining Your Improved Credit Score

Maintaining your improved credit score is crucial after fixing an awful credit score. Follow these steps to ensure long-term success: consistently pay bills on time, keep credit card balances low, avoid opening unnecessary accounts, regularly monitor your credit report, and be mindful of your credit utilization ratio.

Maintaining Your Improved Credit Score Regular Monitoring of Your Credit Keep track of your credit report regularly. Healthy Financial Habits to Adopt Pay bills on time. Avoid maxing out credit cards. Regular Monitoring of Your Credit Check for errors or fraudulent activity. Healthy Financial Habits to Adopt Budget wisely and save for emergencies. Regular Monitoring of Your Credit Review credit utilization and payment history. Healthy Financial Habits to Adopt Limit new credit applications and prioritize debt repayment.Conclusion: The Journey To Credit Recovery

Successfully fixing an awful credit score requires a journey towards credit recovery. This journey involves understanding your credit report, making timely payments, managing debt, and being patient. With time, dedication, and discipline, a bad credit score can be improved.

Setting Realistic Goals

Setting achievable objectives is crucial for credit recovery. Establish clear targets to track progress effectively. Create a realistic plan to improve credit score gradually.Patience And Persistence

Maintain consistency in following the recovery plan. Stay patient as credit improvement takes time. Regularly monitor credit reports to track changes. Embarking on the path to credit recovery requires dedication. Setting realistic goals and being patient are key factors. Persistence is vital in overcoming setbacks and challenges. Stay committed to the journey for long-term credit health.

Credit: www.experian.com

Frequently Asked Questions

Can You Fix A Ruined Credit Score?

Yes, you can improve a ruined credit score by paying off debts, disputing errors, and using credit responsibly.

How To Fix A Bad Credit Score Asap?

To fix a bad credit score ASAP, start by paying your bills on time and reducing your outstanding debt. Dispute any errors on your credit report and limit new credit inquiries. Consider getting a secured credit card and asking for a credit limit increase on existing cards.

It may take time, but consistent effort can improve your credit score.

Is There A Way To Fix Bad Credit Score?

Yes, bad credit can be fixed by paying bills on time, reducing debt, and disputing errors on your credit report.

How Do I Clear My Bad Credit Score?

To clear your bad credit score, follow these steps: 1. Pay your bills on time and in full. 2. Reduce your credit card balances. 3. Dispute any errors on your credit report. 4. Avoid opening new credit accounts. 5. Consider working with a credit counselor to create a plan.

Conclusion

Improving your credit score is a gradual process that requires diligence and patience. By following the tips outlined in this post, you can take proactive steps to rebuild your credit and secure a more stable financial future. Remember, small changes can lead to significant improvements over time.