To get a good job with awful credit, focus on improving your credit score and highlighting your skills and qualifications during the job application process. A strong credit score is not always a determining factor for employers, so it’s important to showcase your abilities and demonstrate your commitment to financial responsibility.

Additionally, networking and leveraging personal connections can help you bypass credit checks and secure job opportunities. By taking proactive steps to improve your credit and emphasizing your strengths, you can increase your chances of landing a good job despite having poor credit.

The Impact Of Credit On Job Searches

Navigating job searches with poor credit can be challenging. Focus on showcasing your skills, experience, and qualifications to potential employers. Consider networking, gaining certifications, and improving your credit score gradually to enhance your job prospects.

How Employers Use Credit Information

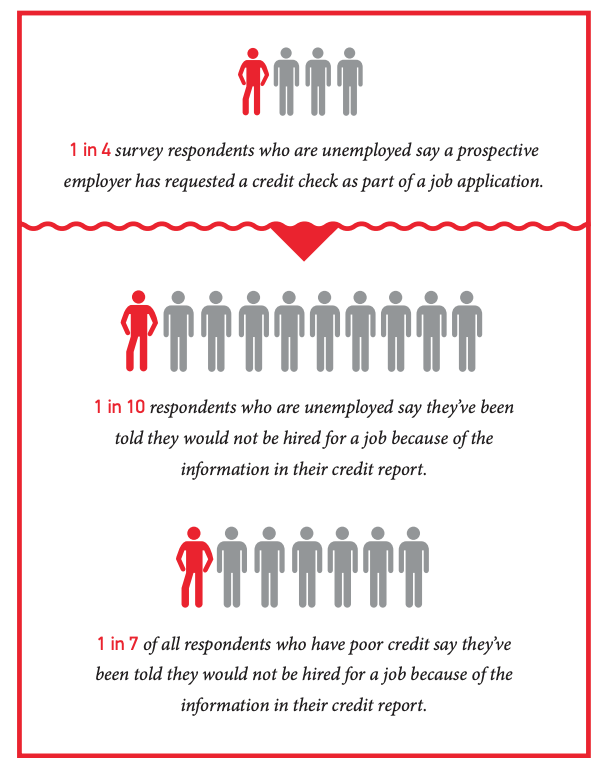

Employers often consider credit information as part of the hiring process, as it can provide insights into a candidate’s financial responsibility and trustworthiness. While not all employers conduct credit checks, some industries, such as finance and government, are more likely to request this information. Understanding how employers use credit information can help you navigate the job search process with confidence.

Credit Checks: When And Why They Matter

Credit checks are typically conducted during the later stages of the hiring process, usually after an initial interview or when a job offer is extended. Employers may use credit information to assess a candidate’s financial stability, as excessive debt or a history of late payments could raise concerns about reliability and judgment. However, it’s important to note that credit checks are subject to legal restrictions and must be conducted with the candidate’s consent.

While a poor credit history may raise red flags for some employers, it does not necessarily disqualify you from getting a good job. Many employers understand that financial challenges can arise due to various circumstances, and they prioritize qualifications, skills, and experience above credit scores. Here are some strategies to help you overcome the impact of bad credit during your job search:

- Focus on your strengths and highlight relevant skills and accomplishments in your resume and cover letter.

- Prepare a concise explanation for any credit issues, emphasizing what you have learned and how you have taken steps to improve your financial situation.

- Consider obtaining professional certifications or completing relevant courses to demonstrate your commitment to professional growth.

- Network extensively and tap into personal connections, as referrals can often bypass the initial credit check stage.

- Be proactive in addressing credit issues by working towards improving your credit score and resolving outstanding debts.

Remember, your credit history may impact your job search to some extent, but it does not define your worth as a candidate. By focusing on your qualifications, demonstrating your dedication, and addressing any credit concerns upfront, you can increase your chances of securing a good job, regardless of your credit score.

Myths About Credit And Employment

Many people believe that having bad credit can hinder their chances of getting a good job, but this is a common myth. Employers are not allowed to make hiring decisions based solely on credit scores, and there are laws in place to protect job seekers from discrimination based on credit history.

With the right skills and qualifications, it is still possible to secure a good job despite having poor credit.

Debunking Common Misconceptions

Myths About Credit and Employment: Having poor credit can make it difficult to get a job, but it doesn’t necessarily disqualify you from being hired. There are many misconceptions surrounding credit and employment that can make job seekers feel hopeless. In this article, we will debunk some of the common myths and provide you with the truth behind credit and hiring decisions.The Truth Behind Credit And Hiring Decisions

Myth #1: Employers Always Check Credit Scores It is not always the case that employers check credit scores. Some employers only check credit reports, while others don’t check at all. This is because credit checks are expensive, and not all employers see the value in doing them. Myth #2: Bad Credit Automatically Disqualifies You from Getting Hired This is a common misconception. Although some employers may use credit history as a factor in their hiring decision, it is not the only factor. Employers may also look at your work experience, education, and references. Moreover, some states have laws that prohibit employers from using credit history as a factor in hiring decisions. Myth #3: Credit Checks are Only Done for Financial Jobs Credit checks are not limited to financial jobs. Employers may check credit history for any position that requires a high level of trust, such as a government job or a job in the healthcare industry. However, if your credit history is not directly related to the job you are applying for, it may not be a factor in the hiring decision.The Bottom Line

In conclusion, having bad credit can make job hunting more challenging, but it is not an automatic disqualification from being hired. Debunking these common myths should give job seekers a better understanding of the role credit plays in the hiring process. Remember, there are many factors that go into a hiring decision, and having bad credit is just one of them. Focus on your strengths, and don’t let your credit history hold you back from pursuing your dream job.Preparing For The Job Hunt

Assessing Your Credit Situation

Before diving into the job search, it’s crucial to assess your credit situation. Understanding your credit score and history will help you anticipate any potential hurdles during the application process.

Improving Your Credit Report Before Applying

To increase your chances of securing a good job with bad credit, it’s essential to proactively work on improving your credit report. Taking steps to rectify any errors or delinquencies can significantly enhance your financial standing and appeal to potential employers.

Credit: www.self.inc

Crafting Your Resume And Cover Letter

Crafting an effective resume and cover letter is crucial when trying to secure a good job despite having a poor credit history. By highlighting relevant skills, accomplishments, and focusing on showcasing your potential, you can still make a strong impression on potential employers.

Crafting Your Resume and Cover Letter is a crucial step in getting a good job with awful credit. Your resume and cover letter are your first impression and can make or break your chances of landing an interview. Here are some tips to help you highlight your strengths, address potential credit concerns, and stand out from other applicants.Highlighting Your Strengths Unrelated To Credit

When crafting your resume and cover letter, focus on highlighting your strengths and qualifications that are unrelated to your credit. This can include your education, work experience, skills, and achievements. Use bullet points and concise sentences to showcase your accomplishments and make them easy to read. For example, instead of mentioning your credit score, highlight your experience in managing budgets, analyzing financial data, or improving company profitability. By emphasizing your strengths, you can show potential employers that you are a strong candidate regardless of your credit history.Addressing Potential Credit Concerns Tactfully

It’s important to address potential credit concerns in your resume and cover letter, but do it tactfully. Be honest about your credit history but focus on the steps you are taking to improve it. For example, you can mention that you have experienced financial setbacks in the past but are currently working with a credit counselor to improve your credit score. You can also provide references who can speak to your work ethic and character. Remember to keep your tone positive and confident. Avoid apologizing or making excuses for your credit history. Instead, focus on your strengths and what you can bring to the company. In summary, crafting a strong resume and cover letter is essential when you have poor credit. By highlighting your strengths and addressing potential credit concerns tactfully, you can increase your chances of getting a good job.Strategic Job Searching

When you have awful credit, finding a good job can seem like an uphill battle. However, with a strategic approach, you can increase your chances of landing a job despite your credit situation. Strategic job searching involves targeting roles that are less likely to require credit checks and leveraging networking to bypass credit hurdles. By focusing on these strategies, you can maximize your opportunities and secure a good job, regardless of your credit history.

Targeting Roles Less Likely To Require Credit Checks

One effective way to overcome the challenge of bad credit when job hunting is to target roles that are less likely to require credit checks. Many industries and positions don’t consider credit history as a determining factor for employment. By narrowing your job search to these roles, you can avoid potential rejections based solely on your credit score.

Consider exploring industries such as healthcare, education, government, and non-profit organizations. These sectors often prioritize qualifications, skills, and experience over creditworthiness. Look for job titles like nurse, teacher, public servant, or social worker, as they typically have less emphasis on credit checks during the hiring process.

Leveraging Networking To Bypass Credit Hurdles

Networking can be a powerful tool for job seekers with bad credit. Building strong connections and leveraging personal relationships can help you bypass credit hurdles that might arise during the application process. By tapping into your network, you can potentially find job opportunities that are not publicly advertised and secure recommendations or referrals from trusted contacts.

Start by reaching out to friends, family, former colleagues, and acquaintances who may have connections in your desired industry. Attend professional networking events, join online communities, and engage with industry-specific groups on social media platforms. By actively networking and showcasing your skills and abilities, you can increase your chances of finding job opportunities that may not require credit checks or where your credit history may carry less weight.

Acing The Interview

Effective Responses To Credit Concerns

When asked about your credit history during an interview, be prepared to address it openly and honestly. Take responsibility for any past financial challenges and highlight the steps you’ve taken to rectify the situation. Emphasize your commitment to financial responsibility and how it has positively impacted your current financial standing.

Showcasing Reliability And Responsibility

During the interview, demonstrate your reliability and responsibility through specific examples from your work experience. Highlight instances where you’ve successfully managed financial responsibilities, exhibited strong work ethics, and maintained a high level of accountability. Illustrate how these qualities are indicative of your overall character and reliability as an employee.

Negotiating Job Offers

Negotiating job offers can be a daunting task, especially when you have a bad credit score. However, with proper preparation, research, and communication, it is possible to secure a good job even with awful credit. Focus on highlighting your skills and qualifications, addressing any concerns the employer may have, and negotiating a fair compensation package.

Discussing Your Credit History Honestly

Be transparent about credit issues upfront.

Explain any past financial challenges candidly.

Securing The Position Without Credit As A Barrier

Showcase skills and experience confidently.

Highlight relevant achievements and qualifications.

Credit: www.experian.com

Long-term Strategies For Career Success

Long-term strategies for career success are vital, especially when dealing with poor credit. By focusing on continual credit improvement and career advancement without credit implications, individuals can position themselves for a successful professional future.

Continual Credit Improvement

Regularly monitor credit reports and address any errors. Set up automatic payments to avoid late fees.

Reduce debt by paying more than the minimum amount due each month.

Seek financial counseling to develop a plan for improving credit over time.

Career Advancement Without Credit Implications

Focus on building skills and experience to advance professionally.

Network with industry professionals to explore growth opportunities.

Demonstrate reliability and commitment to employers through excellent work performance.

Additional Resources And Support

When facing the challenge of securing a good job with poor credit, it’s essential to utilize various resources and support systems that can assist in improving your financial standing. By accessing professional services for credit repair and educational tools for financial management, you can enhance your chances of landing a desirable job opportunity.

Professional Services For Credit Repair

- Consult with credit repair specialists for tailored solutions.

- Get assistance in disputing errors on your credit report.

- Receive guidance on improving your credit score effectively.

Educational Tools For Financial Management

- Access online courses on budgeting and financial planning.

- Utilize apps for tracking expenses and monitoring credit.

- Attend workshops on improving financial literacy and money management.

Credit: www.amazon.com

Frequently Asked Questions

Will I Get Hired If I Have Bad Credit?

Your bad credit may not directly affect your hiring prospects. Employers generally focus on qualifications and experience. However, certain industries, such as finance, may conduct credit checks. It’s best to be honest about your situation during the hiring process.

Can I Be Denied A Job Due To Bad Credit?

Yes, it is possible for a potential employer to deny a job due to bad credit. This is because some employers view an individual’s credit history as an indication of their responsibility and trustworthiness. However, not all employers check credit scores and it depends on the job type and industry.

What Credit Score Is Too Low For A Job?

A credit score that is too low for a job varies depending on the employer’s requirements. Some employers may not consider applicants with credit scores below 600, while others may have a higher threshold. It’s important to check with the specific employer to know their credit score criteria for job applicants.

How To Explain Bad Credit To Potential Employer?

Be honest about your situation and emphasize steps taken to improve it. Highlight your skills and qualifications. Offer references to vouch for your work ethic and reliability. Discuss how you’ve learned from past mistakes and are committed to financial responsibility.

Conclusion

In a competitive job market, having bad credit can be a hurdle. But by improving financial habits, seeking alternative opportunities, and highlighting strengths, you can still land a good job. Remember, determination and persistence are key to overcoming challenges and achieving success in your job search despite credit setbacks.