To use credit to pay for AWS, simply add your credit card information to your AWS account, select the services you want to use, and AWS will automatically charge your credit card for the usage. This allows you to easily access and pay for AWS services without the need for manual invoicing or payment processing.

By using credit to pay for AWS, you can take advantage of the flexibility and convenience of online payments while benefiting from the extensive range of services and resources offered by AWS. With credit payment, you can seamlessly scale your usage and only pay for what you need, making it a convenient and efficient option for businesses of all sizes.

Introduction To Aws And Credit Payment Options

AWS, or Amazon Web Services, is a cloud computing platform that offers a wide range of services to businesses. One of the convenient features of AWS is the ability to pay for services using credit. Understanding how to use credit to pay for AWS services can streamline your payment process and provide flexibility.

Benefits Of Aws For Businesses

- Scalability

- Cost-effectiveness

- Reliability

- Security

Overview Of Credit Payment Methods

When it comes to paying for AWS services using credit, businesses have various options available. Credit card payments are commonly used, offering convenience and flexibility. AWS credits are another option that can be applied to your account, providing discounts or free usage for specific services.

Evaluating Your Aws Usage

You can use credit to pay for your AWS usage, providing a flexible payment option. Evaluate your AWS usage to determine the best approach for utilizing credit and optimizing your spending. Keep track of your credit balance and adjust your usage accordingly to make the most of this payment method.

Tracking Your Service Consumption

To use credit to pay for AWS, you need to evaluate your AWS usage. This means keeping track of your service consumption to determine where you are spending your money. Tracking your service consumption will help you identify areas where you can optimize your usage and reduce your costs. One way to track your service consumption is by using the AWS Cost Explorer. This tool allows you to analyze your AWS costs and usage patterns over time. You can use it to identify cost drivers, track usage trends, and forecast your future costs. With this information, you can make informed decisions about how to optimize your usage and reduce your costs.Tools For Monitoring Aws Expenses

Another way to evaluate your AWS usage is by monitoring your AWS expenses. This involves tracking your costs in real-time and identifying any unexpected or unusual spending patterns. By monitoring your expenses, you can quickly identify any issues and take action to resolve them before they become a problem. There are several tools available for monitoring AWS expenses, including AWS Budgets and AWS Cost and Usage Reports. AWS Budgets allows you to set custom cost and usage budgets for your AWS resources. You can receive alerts when you exceed your budget, and take action to reduce your spending. AWS Cost and Usage Reports provide detailed information about your AWS usage and costs, including hourly and daily usage data. In conclusion, evaluating your AWS usage is essential if you want to use credit to pay for AWS. By tracking your service consumption and monitoring your expenses, you can optimize your usage, reduce your costs, and make informed decisions about how to use your AWS resources.Credit Cards And Aws Billing

Credit cards are a convenient and widely used method of payment, and when it comes to managing your AWS billing, they offer a seamless way to handle your expenses. In this guide, we’ll explore the steps for setting up a credit card for AWS payments and managing credit card information securely.

Setting Up A Credit Card For Aws Payments

Setting up a credit card for AWS payments is a straightforward process. Once you’ve logged into your AWS Management Console, navigate to the billing section and select “Payment Methods.” From there, you can add your credit card details, including the card number, expiration date, and security code.

Managing Credit Card Information Securely

Security is paramount when it comes to managing credit card information for AWS payments. AWS provides robust security measures to safeguard your payment details. You can utilize AWS Key Management Service (KMS) to encrypt your credit card information, adding an extra layer of protection to your sensitive data.

Credit: aws.amazon.com

Maximizing Credit Card Rewards

If you’re an AWS user, you know that the cost of running your applications and services can add up quickly. One way to help offset those costs is by using a credit card that earns rewards. By choosing the right rewards card and using some simple strategies, you can earn points or cash back on your AWS spending. Here are some tips to help you maximize your credit card rewards.

Choosing The Right Rewards Card

Not all rewards cards are created equal. When choosing a rewards card, consider the following:

| Annual fee: | Some rewards cards charge an annual fee. Make sure the rewards you’ll earn will offset the fee. |

| Points or cash back: | Some rewards cards earn points that can be redeemed for travel or merchandise, while others earn cash back. Decide which type of reward you prefer. |

| Bonus categories: | Look for a card that offers bonus points or cash back for spending in categories that align with your AWS spending, such as internet services or business purchases. |

Strategies For Earning Points And Cash Back

Once you’ve chosen a rewards card, there are several strategies you can use to maximize your rewards:

- Pay your bill in full: Rewards cards often have high interest rates, so it’s important to pay your bill in full each month to avoid interest charges.

- Use your card for all AWS spending: Make sure to use your rewards card for all of your AWS spending to earn as many points or cash back as possible.

- Take advantage of bonus categories: If your card offers bonus points or cash back for spending in certain categories, make sure to take advantage of those bonuses.

- Redeem your rewards wisely: Some rewards are more valuable than others. For example, cash back is usually worth one cent per point, while travel rewards can be worth more. Make sure to redeem your rewards for maximum value.

By choosing the right rewards card and using these strategies, you can earn valuable rewards on your AWS spending. Just remember to always pay your bill in full and use your card responsibly to avoid debt.

Budgeting For Aws Costs

Learn how to effectively budget for AWS costs and make use of credit to pay for your services. Gain insights on managing your expenses and optimizing your cloud infrastructure while staying within your budget.

Creating A Budget For Cloud Services

When it comes to managing your AWS costs, creating a budget is a crucial step that can help you stay on track and avoid any unexpected surprises. By setting a budget for your cloud services, you can effectively plan and allocate your resources, ensuring that you are optimizing your spending and getting the most out of your AWS experience.

Here are a few key steps to help you create a budget for your AWS costs:

- Estimate your monthly usage: Start by analyzing your historical data and usage patterns to estimate your monthly AWS usage. This can include factors such as the number of instances, storage, data transfer, and any additional services you plan to use.

- Identify cost drivers: Identify the main cost drivers for your AWS usage. This could be specific services, regions, or instances that contribute significantly to your overall costs. By understanding these drivers, you can prioritize your budget allocation accordingly.

- Set spending limits: Determine the maximum amount you are willing to spend on AWS services each month. This will help you avoid overspending and ensure that your expenses are within your budgetary constraints.

- Monitor and track expenses: Regularly monitor and track your AWS expenses to stay informed about your spending patterns. This can be done through the AWS Cost Explorer, which provides detailed insights into your usage and costs.

Adjusting Budgets Based On Usage Patterns

Once you have established your initial budget, it is important to review and adjust it based on your usage patterns. AWS offers various tools and features that can assist you in optimizing your budget allocation:

- Utilize AWS Cost Explorer: Leverage the AWS Cost Explorer to gain visibility into your usage and spending trends. This tool enables you to analyze your usage patterns over time and identify areas where you can potentially reduce costs.

- Implement cost-saving measures: Take advantage of AWS’s cost-saving measures, such as Reserved Instances, Savings Plans, and Spot Instances. These options allow you to pre-pay or bid for instances at lower prices, helping you optimize your budget and reduce expenses.

- Automate resource management: Utilize AWS tools like AWS Lambda and AWS Auto Scaling to automate resource provisioning and de-provisioning. This ensures that you are only using resources when needed, thereby minimizing unnecessary costs.

- Regularly review and adjust: Continuously review your budget and adjust it based on changes in your usage patterns and business requirements. By regularly optimizing your budget, you can ensure that your AWS costs remain aligned with your needs.

Aws Cost Optimization Techniques

When managing an AWS infrastructure, it’s crucial to optimize costs to ensure efficient resource utilization and maximize savings. Implementing the following techniques can help you achieve significant cost reductions while maintaining optimal performance.

Identifying Underutilized Resources

Regularly assess your AWS infrastructure to identify and address underutilized resources. Utilize AWS Cost Explorer to analyze historical data and identify instances with low utilization. Consider leveraging Amazon CloudWatch to monitor resource usage and identify instances that consistently operate below capacity.

Implementing Auto-scaling To Reduce Costs

Implement auto-scaling to dynamically adjust resource capacity based on demand. Utilize AWS Auto Scaling to automatically adjust the number of instances in response to fluctuating workloads. Leverage policies to define scaling rules based on performance metrics and ensure optimal resource utilization.

Leveraging Aws Credits

To pay for AWS services, you can use credits earned through various AWS programs. These credits can be applied directly to your account balance, reducing or even eliminating your bill. Leveraging AWS credits is a cost-effective way to manage your AWS expenses.

Acquiring Aws Promotional Credits

Utilize AWS promotional credits to reduce costs.

Best Practices For Using Aws Credits

Optimize AWS credits for maximum benefit.

Alternative Financing Options For Aws

When it comes to covering the costs of AWS services, there are various financing options available. Exploring these alternatives can help you manage your expenses efficiently and optimize your cloud investments.

Exploring Aws Marketplace And Third-party Offers

AWS Marketplace: A platform offering a wide range of software solutions and services that can be purchased to enhance your AWS experience.

- Benefits: Access to a curated selection of products, simplified procurement processes, and consolidated billing.

- Considerations: Ensure compatibility with your existing AWS setup and review pricing structures carefully.

Third-Party Offers: Many vendors provide tools and services that complement AWS functionalities, offering flexibility and customization options.

- Advantages: Tailored solutions to meet specific needs, potential cost savings, and specialized support.

- Caution: Evaluate the reputation and reliability of third-party providers before making a commitment.

Considering Loans And Financing For Cloud Investments

Loans: Securing a loan from a financial institution can provide immediate funds to cover AWS expenses, with repayment terms based on your financial situation.

- Benefits: Quick access to capital, potential tax advantages, and the ability to spread costs over time.

- Points to Note: Understand the interest rates, fees, and impact on cash flow before taking out a loan.

Financing: Specialized financing options for cloud investments may offer structured payment plans and benefits tailored to AWS users.

- Perks: Flexible payment schedules, lower upfront costs, and potential incentives for long-term commitments.

- Consideration: Review the terms and conditions, including any hidden fees or penalties, to make an informed decision.

Staying Updated With Aws Pricing Changes

Subscribing To Aws Pricing Notifications

Receive real-time updates on pricing changes to manage costs effectively.

Impact Of Pricing Updates On Budget Planning

Stay ahead with accurate budget forecasts in line with AWS pricing adjustments.

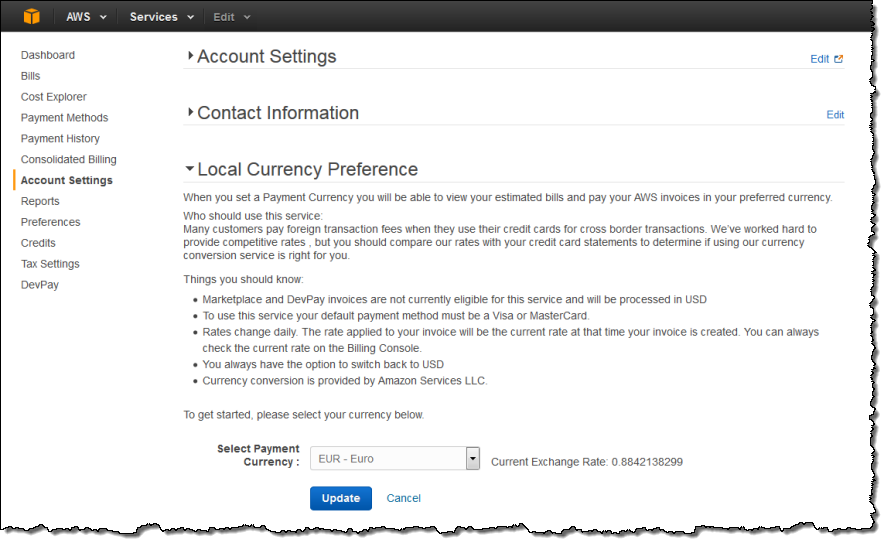

Credit: aws.amazon.com

Conclusion: Smart Finance Management For Aws

Effectively manage your finances with smart credit usage for AWS payments. Utilize credit to pay for AWS services, optimizing your financial strategy for enhanced flexibility and control over your budget. Embrace the benefits of leveraging credit for seamless AWS management.

Recap Of Key Strategies

Reviewing key strategies for effective AWS payment using credit.

Planning For Future Aws Investments

Strategies for planning future investments in AWS services.

In conclusion, smart finance management is crucial for utilizing credit to pay for AWS services efficiently. By following the key strategies outlined and planning for future investments, businesses can optimize their financial resources for sustainable growth.

Credit: aws.amazon.com

Frequently Asked Questions

Can I Pay Aws Bill With Credit Card?

Yes, you can pay your AWS bill with a credit card. AWS accepts various credit cards, including Visa, Mastercard, American Express, Discover, and JCB. You can set up your payment method in the Billing and Cost Management console and choose to pay your bill automatically or manually.

How To Redeem An Aws Credit?

To redeem an AWS credit, log in to your AWS account, go to the billing dashboard, and apply the credit.

What Is The Use Of Aws Credit?

AWS credits are used to pay for AWS services, reducing your overall bill. They help offset costs and encourage usage of AWS resources.

Can I Convert Aws Credits To Cash?

No, AWS credits cannot be converted into cash. They can only be used to pay for eligible AWS services.

Conclusion

Utilizing credit to pay for AWS services can be a smart financial strategy. By understanding the benefits of credit, such as building a positive credit history and taking advantage of rewards programs, individuals and businesses can maximize their purchasing power.

Additionally, careful budgeting and monitoring of credit usage can help avoid unnecessary fees and interest charges. By following these tips and leveraging credit wisely, you can make the most of your AWS experience while maintaining financial stability.