Removing a credit card from AWS will result in the loss of payment information and the inability to make purchases or payments on the platform. Without a valid credit card on file, you will not be able to access certain services or resources offered by AWS.

It is important to carefully consider the consequences before removing a credit card from your AWS account.

Removing Credit Card From Aws: Potential Consequences

Removing your credit card from AWS can lead to service interruptions and possible loss of data. It may affect auto-renewals, resulting in account suspension. Take caution before making changes to avoid any negative impact on your AWS account.

Service Disruptions

Unexpected service disruptions may occur.

Resource access might be restricted.

Immediate Account Suspension

Account suspension may happen instantly.

Data loss and service interruptions might result.

Billing And Service Interruptions

If you remove your credit card from AWS, billing and service interruptions may occur. It is essential to update payment information promptly to avoid any disruption in your account. Be proactive in managing your billing details to prevent any service disruptions.

Unpaid Bills And Penalties

Removing your credit card from AWS can lead to unpaid bills and penalties. AWS charges you based on the services you use and the resources you consume. If your payment method is removed or fails, AWS will try to charge your backup payment method. If that fails too, your AWS account will be suspended, and you won’t be able to access your resources until you pay your overdue balance. AWS adds a late payment fee of 1.5% per month or the maximum allowed by law, whichever is less, on your unpaid balance. The late payment fee can accumulate quickly and become a significant amount over time. Therefore, it’s essential to keep your payment information updated and ensure that you have sufficient funds in your payment accounts.Impact On Ongoing Projects

Removing your credit card from AWS can also impact your ongoing projects. If you have unpaid bills, AWS may suspend your account and stop all your running services. This can lead to data loss, service interruptions, and delays in your project timelines. Moreover, if your AWS account is suspended, you won’t be able to launch new resources or make changes to your existing resources. This can be frustrating, especially if you have urgent project needs or deadlines to meet. Therefore, it’s crucial to keep your payment information updated and ensure that you have sufficient funds in your payment accounts to avoid service interruptions. In conclusion, removing your credit card from AWS can have severe consequences if you have unpaid bills or ongoing projects. It’s essential to keep your payment information updated and ensure that you have sufficient funds in your payment accounts to avoid service interruptions and penalties.Data Retention Considerations

Access To Data Post-removal

After removing credit card information from AWS, it’s vital to consider how this action impacts access to data. Once the card is removed, access permissions should be reviewed to ensure that only authorized individuals can retrieve or modify sensitive information. It’s crucial to maintain strict control over who can access the data post-removal.

Backup Strategies

When removing credit card details from AWS, it’s essential to evaluate the backup strategies in place. Ensuring that all critical data is backed up securely is imperative to prevent any potential loss. Implementing a robust backup plan before removing the credit card information can safeguard against unforeseen data loss and facilitate a smooth transition.

Credit: m.youtube.com

Impact On Aws Support And Resources

Removing your credit card from AWS may impact your ability to access certain resources and support options. Without a valid payment method, you may experience service disruptions and limitations on account management. It’s important to consider the potential ramifications before making any changes to your billing information.

Impact on AWS Support and Resources: When it comes to removing a credit card from AWS, there are various impacts that need to be considered. One of the most important impacts is on AWS support and resources. In this section, we will discuss the impact of removing a credit card on AWS support and resources using H3 headings. H3: Loss of Support Access Removing a credit card from AWS can lead to a loss of support access. AWS provides various support plans, including basic, developer, business, and enterprise support. These support plans offer different levels of support, such as 24/7 access to AWS Trusted Advisor, AWS Infrastructure Event Management, and AWS Support Concierge. However, to access these support plans, you need to have a valid payment method on file. If you remove your credit card, you may lose access to your current support plan or be downgraded to a lower level of support. H3: Resource Scaling Limitations Another impact of removing a credit card from AWS is resource scaling limitations. AWS offers various services such as EC2, RDS, and S3, which allow you to scale resources up or down based on your requirements. However, to use these services, you need to have a valid payment method on file. If you remove your credit card, you may not be able to scale your resources beyond a certain limit. This can impact your ability to handle sudden spikes in traffic or accommodate growing data needs. To summarize, removing a credit card from AWS can have a significant impact on your access to support plans and resource scaling capabilities. Therefore, it is important to consider the implications before making any changes to your payment information.Tips For Safely Changing Payment Methods

When removing a credit card from AWS, it is important to follow these tips for safely changing payment methods. Be cautious, review your account settings, update your payment information, and ensure a smooth transition to avoid any billing issues or disruptions in your AWS services.

Updating To A New Card

When it comes to changing your payment method on AWS, it’s important to follow the right steps to ensure a smooth transition. One of the first things you need to do is update your credit card information to a new card. Here are a few tips to help you through the process:

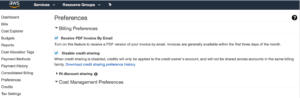

- Log in to your AWS account and navigate to the Billing and Cost Management console.

- Click on “Payment Methods” and select the credit card you want to remove.

- Choose the option to “Remove” the card and confirm the action.

- Next, click on “Add a Payment Method” and enter the details of your new credit card.

- Make sure to double-check the accuracy of the information before saving the changes.

Ensuring Service Continuity

Changing your payment method should not disrupt your AWS services. To ensure a smooth transition and uninterrupted access to your resources, follow these steps:

- Review your active services and note any critical ones that require constant availability.

- Consider scheduling the payment method change during a period of low usage or during a maintenance window.

- If you have any recurring payments or subscriptions, update the payment information to avoid any interruptions.

- Monitor your account closely after the payment method change to ensure that all services are functioning as expected.

By following these tips, you can safely change your payment method on AWS without any hiccups. Remember to update your credit card information and take necessary precautions to ensure service continuity. With a smooth transition, you can continue to enjoy the benefits of AWS without any disruptions.

Credit: www.youtube.com

Communication With Aws Support

Communication with AWS Support is crucial when handling disputes, negotiating payment terms, and seeking assistance with credit card removal. AWS offers various channels for customer support, ensuring that businesses can quickly address any issues that may arise in their accounts.

Handling Disputes

When encountering billing discrepancies or unauthorized charges, promptly reach out to AWS Support. Provide clear documentation and a thorough explanation of the dispute to expedite the resolution process.

Negotiating Payment Terms

If facing financial challenges, engage with AWS Support to discuss flexible payment options. Present a detailed plan for how you intend to fulfill your financial obligations, demonstrating your commitment to resolving the issue.

Alternative Payment Solutions

Removing credit card as a payment method from AWS might limit your options, but alternative payment solutions are available. Consider options such as bank transfers, PayPal, or cryptocurrency to ensure seamless payments and uninterrupted services.

Using prepaid cards and exploring AWS credits and grants are two alternative payment solutions that can be considered when removing a credit card from AWS.Using Prepaid Cards

Prepaid cards offer a convenient way to pay for AWS services without needing a credit card.Exploring Aws Credits And Grants

AWS provides credits and grants which can be utilized as an alternative method of payment for services.Future-proofing Your Aws Account

To future-proof your AWS account, it’s crucial to consider the implications of removing your credit card. Doing so could lead to service interruptions, potential loss of data, and account suspension. It’s advisable to review and update your billing information to avoid any disruptions in AWS services.

Setting Budget Alerts

Ensure your AWS account stays within budget by setting alerts for spending limits.

Monitoring Usage And Costs

Regularly check your AWS account to track usage and costs for optimal efficiency.

Future-proofing your AWS account involves taking proactive steps to secure your financial stability and prevent unexpected expenses. Setting budget alerts and monitoring usage and costs are essential strategies to safeguard your AWS account. By setting budget alerts, you can receive notifications when approaching predefined spending limits, allowing you to stay within budget. Monitoring usage and costs enables you to identify any anomalies or areas for cost optimization, ensuring you make informed decisions for your AWS account.Credit: www.businessinsider.com

Frequently Asked Questions

Can You Remove A Credit Card From An Aws Account?

Yes, you can remove a credit card from an AWS account by navigating to the Payment Methods section, selecting the credit card you want to remove, and clicking on the Delete button.

How Do I Stop Aws From Charging Me?

To stop AWS charges, delete unused resources, turn off instances, set up billing alerts, and monitor usage regularly.

Will I Still Be Charged If I Delete My Aws Account?

If you delete your AWS account, you won’t be charged any recurring fees. However, you may still need to pay for any outstanding bills or charges incurred before deleting your account.

Can I Close My Aws Account Without Paying The Bill?

Yes, you can close your AWS account without paying the bill. Just make sure all outstanding charges are settled before closing.

Conclusion

Removing a credit card from AWS requires careful consideration. It’s important to assess the impact on your services and billing. By following the necessary steps and monitoring your account, you can ensure a smooth transition and avoid any potential issues.

Proper planning is key to managing your AWS account effectively.